Financial Freedom is a Necessity for Us

Financial freedom is essential for black women. It is not an aspirational goal but a critical foundation for empowerment and security.

Once I started working as a lawyer in 2009, I knew that I needed an exit strategy. I was miserable at my law firm and was $230,000 in debt. Learning how to become financially free was a necessity for me.

Taking action and learning as much as possible about personal finance helped me go from $230,000 in debt to a net worth of over $2 million today.

Disproportionately, black women and people of color encounter historical, systemic barriers to economic resources, restricting their ability to accumulate wealth.

According to the Federal Reserve’s 2019 Survey of Consumer Finances, the average net worth of white households in the U.S. is nearly ten times greater than that of black households.

This significant disparity highlights the urgent need for strategies aimed at closing the racial wealth gap.

The Economic State of Black America

The latest Economic State of Black America report underscores several vital facts and takeaways concerning the financial landscape:

- Wealth Disparity Continues to Widen: This disparity is rooted in historical inequalities that hinder wealth accumulation in black communities.

- Income Inequality is Persistent: Despite improvements in educational attainment among black Americans, income inequality persists. Black workers often earn less than their white counterparts, even with comparable levels of education and experience.

- Entrepreneurship as a Pathway to Wealth: While black women are starting businesses at a faster rate than any other demographic, they face substantial barriers to growth, including limited access to funding.

- Investment in Education Pays Off: Higher education remains a key driver of economic success. However, black students face higher rates of student loan debt, emphasizing the need for equitable access to affordable education. This was true foe me. I had over $230,000 in student loan debt after leaving law school.

These observations highlight the critical need for us as black women to overcome financial disparities and build lasting wealth.

Let’s Normalize Black Women Achieving Financial Freedom

Achieving financial freedom offers a pathway to overcoming these obstacles, enabling black women to invest in their futures, protect their families, and contribute to the economic well-being of their communities.

It’s about creating a legacy of wealth. This can break intergenerational cycles of disparity and lay the groundwork for future generations to thrive financially.

As a black woman navigating the path to financial freedom, I’ve discovered that empowerment comes from knowledge, action, and resilience.

In this guide, I’ll share with you practical strategies and actionable steps that I’ve personally used to build wealth and secure my financial future.

Read my post on early retirement where I walk you through each step of my financial freedom journey.

My aim is to empower you with the tools and confidence you need to take control of your finances. I want us to break free from economic constraints, limiting beliefs, and start building legacies of wealth.

It’s time to turn our financial dreams into achievable goals, and I’m here to show you how.

No one is coming to save us, certainly not the government. We have to come to our own financial rescue.

Financial Freedom for Black Women Defined

Historically, black women have been positioned unfavorably in the economic landscape, earning consistently less than white women and men in similar professional roles.

Beyond the wage gap, various systemic issues have historically held us back from accumulating wealth.

Addressing these unique challenges requires a multifaceted approach, recognizing the deep-seated structural inequalities that underpin the financial experiences of black women.

It involves advocating for policy changes, promoting financial literacy, and creating supportive networks to empower black women of any age to overcome these barriers and forge paths toward financial freedom.

Most of all, it means educating ourselves and taking action. That is the part we can control. We can take control of our own lives and our own finances.

In this context, financial freedom for black us means autonomy, security, and the unrestricted capacity to make life decisions without worrying about our bank account.

It means that we have several streams of income so we are not solely relying on a W-2 job. Job security these days seems so fragile.

Time after time, I’ve heard stories of Beckies running to HR because they aren’t happy with the professional way we said “no” to a social event.

It means that we can get to a point on the Corporate Ladder and decide it is time to go live in Europe and become an entrepreneur instead.

It is because we invested and saved along the way. It is because we educated ourselves and took that action.

Financial Steps To Help You Move Toward Financial Freedom

Financial literacy is not different in any way for black women. What is different is the urgency with which we need to become financially free. Below are some key goals that will lead to financial independence.

Build an Emergency Fund

The first financial goal you should have is establishing a solid emergency fund. It will give you peace of mind. Aim to save at least three to six months’ worth of living expenses.

- How to start: Start small, perhaps by saving a portion of each paycheck. You can steadily build this fund without overwhelming your budget. Find high yield savings bank accounts that will pay you monthly interest on the money in your account. I have Ally Savings account, and I use the interest it pays me to buy more index funds!

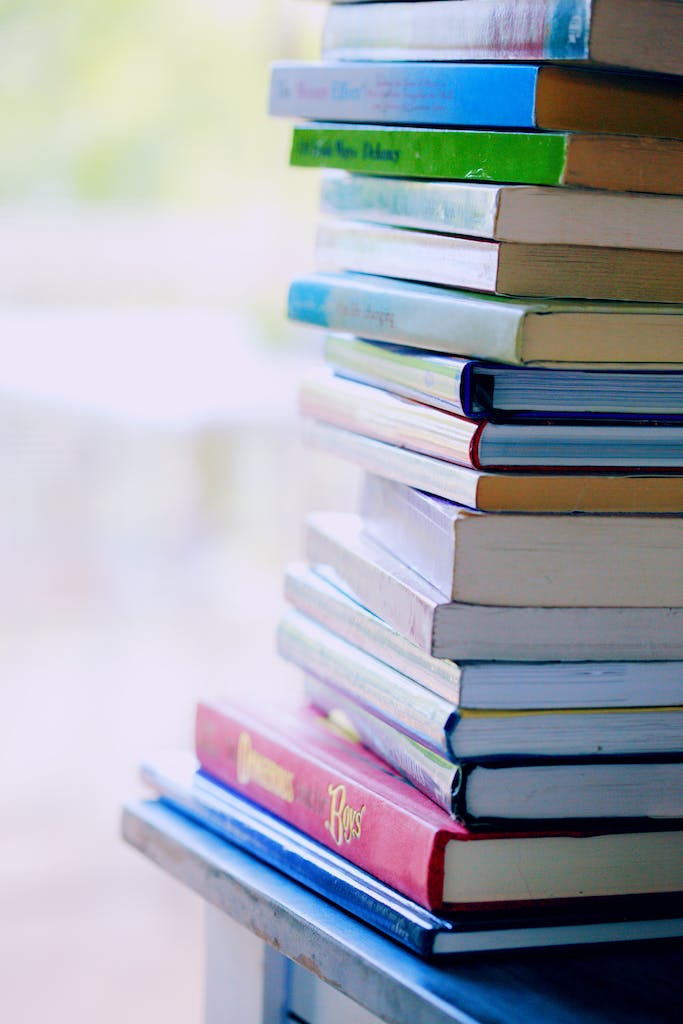

Invest in Education

Education is a powerful tool for breaking cycles of economic disadvantage. Now, this does not have to be costly. One real estate book on Amazon made me over $388,000. I educated myself on real estate, and took massive action.

- Free Book Resources: Many books now can be found online (e-books and audiobooks) through the Library app Libby. I learned so much from listening to books and podcasts during my commute.

- You tube is Free: You tube is also a great resource. I recommend following Ourrichjourney on You tube to get started. Read more about their path to financial independence in this article.

- Courses: I’m also a course junkie. Invested in courses when I wanted to learn a unique skill, like setting up my Etsy store, or this blog.

Own Real Estate

Homeownership or real estate investing can be a key step towards building wealth and securing financial stability. Owning traditional real estate can provide a sense of belonging and a safe, stable environment.

- How to Start: Start by setting aside money for a down payment as your initial goal. While I love what real estate has done for my portfolio, it is not for everyone. Living in a high cost of living area or other factors may impact your ability to purchase a home. If you rent, that is ok! There are so many paths to financial freedom, and real estate is only one.

Entrepreneurship

Starting a business can be a pathway for black women to cultivate wealth on their terms.

- How to Start: Begin with defining a clear business idea. Then work towards it by acquiring the necessary skills, creating a business plan, and exploring funding options designed to support minority women entrepreneurs.

- Try Starting With a Low Cost Side Hustle: Or, if you want to get started with a low cost option, try opening up an Etsy shop or Shopify store like I did! The startup costs are minimal and you can start quickly.

Retirement Planning

Building a comfortable retirement fund ensures long-term financial security.

- How to Start: Start by contributing to a retirement account, like a 401(k) or an IRA, especially if your employer offers matching contributions. Even small, consistent contributions can grow significantly over time due to compound interest.

- Invest in the Near Future: In addition to your retirement accounts, if you intend to retire early, like I plan to, you can invest after tax dollars into a brokerage account. That way you will have access to that money before you hit traditional retirement age. I consistently contributed to both my retirement accounts and my traditional brokerage for 15 years. Any extra money I had left over before payday was used to purchase more index funds. Paying myself first literally paid off!

Eliminate Debt

Debt can be a significant barrier to financial freedom.

- How to Start: Dig into your finances and find strategy to pay off debt that works for you. You might want to start with high-interest debt such as credit card balances. Consider the snowball or avalanche methods for debt repayment. Ultimately, I found that starting with high interest debt on my largest student loans was the best option.

- Consider Investing While Paying Down Debt: Even though prioritizing debt is important, I did not have zero debt when I started investing. I had $230,000 worth of student loans when I started investing. In fact, digging myself out of that huge financial hole, and having a job I hated fueled me to learn everything I could about the financial world. However, I had an emergency fund already established and I knew that I wouldn’t touch (or sell) my investments until I was ready to retire, which ended up being only 15 years later due to compound interest!

Financial Independence Made Possible With the Stock Market

The stock market may seem confusing to many, but it can be a powerful tool for building wealth and achieving financial independence.

With the rise of online platforms and investment apps, accessing the stock market has become more accessible than ever before.

Investing in a stock allows individuals to own a small piece of a company, with the potential for growth and dividends over time.

It’s important to note that the stock market can be volatile, and there are no guarantees of returns. However, by diversifying investments and staying informed about market trends, black women can minimize risks and take advantage of opportunities for growth.

Diversity is Always Important in Personal Finance

I diversify my investments by investing in index funds versus individual stocks.

Index funds are mutual funds that track the performance of a specific index, such as the S&P 500. The S&P 500 is an index that tracks the the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

They allow investors to buy into an already diversified piece of the market with a single investment.

This diversified approach reduces risk and allows for more stable growth over the long term. Over the long term, compound interest will work its magic.

Compound Interest Is Magic

Compound interest, in this context, refers to the earnings on your initial investment as well as on the earnings that accumulate over time.

For instance, if you invest in an index fund, not only do you gain returns on the initial amount invested, but over time, those returns generate their own earnings.

This cycle continues, essentially letting your money work for you. Eventually, you won’t have to work for IT.

The effect of compounding is particularly significant in index funds due to their nature of mirroring the market’s long-term upward trend, leveraging compound interest to build wealth over time.

One key aspect to successful stock market investing is taking a long-term approach. This means holding onto investments for several years, even decades, to reap the benefits of compounding interest.

This is how I grew my wealth, in addition to real estate investing. I didn’t buy individual stocks to build wealth, and I didn’t sell off any index funds when the market went down.

I bought more because they were on sale and I knew that historically, the market would trend back up. And it did!

By staying invested in the market, mainly index funds, for the long-term, black women can take advantage of this powerful growth strategy and achieve financial independence.

Some Additional Financial Tips for Success

- Create a Sustainable Budget: Crafting a budget that aligns with your income, expenses, and financial goals is foundational. It’s not just about tracking where your money goes; it’s about making intentional decisions that support your long-term objectives.

- Believe in the Magic of Compound Interest: Compound interest, often referred to as the eighth wonder of the world, allows your investments to grow exponentially over time. By reinvesting your earnings, you can significantly increase your wealth. Think of compound interest magic as the same as black girl magic. That is how I think about it, because it is wonderful!

- Invest Early and Often: Young professionals take note: the earlier you start investing, the more time your money has to grow, which gives compound interest more time to work its magic! Even if you don’t have a higher-paying career, by establishing a regular investment routine and consistently contributing to your portfolio–whether the market is up or down–you can take advantage of compounding interest and potentially achieve financial independence sooner. Whatever your current age is, do not let that deter you from starting today.

- Regular Financial Check-ups: Just as you would with your health, regular reviews of your financial plan are essential. This allows you to adjust for life changes, market shifts, and ensure you’re on track towards your financial goals.

- Live Life: While it’s essential to save and invest for the future, don’t forget to live in the present. Create a budget that allows you to enjoy a richer life while also being responsible with your money. Remember, finding a balance between saving and spending is key to achieving long-term financial success.

- Make More Money: Along with saving and investing, increasing your income can also help you reach your financial goals faster. Consider finding a side hustle or utilizing this gig economy to earn extra money on your own schedule. Your side hustle can also be an avenue to learn new skills that you can add to your earning potential. For example, I’ve learned graphic design and AI while building my Etsy side hustle. In my early retirement, if I ever wanted to make some extra funds, I could get a freelance gig on Fivver or Upwork.

By incorporating these strategies into your financial planning, you can build a strong foundation for financial success.

Conclusion

While there are many unique challenges in being a black woman today when it comes to achieving financial stability and success, there are also many strategies and resources available to overcome these barriers.

This is not financial advice, but it is a call for educational empowerment.

By educating ourselves, diversifying our investments, and sharing our knowledge with others, we can break cycles of poverty and create a more equitable society for all. I want to see more powerful black women living on their own terms. Remember, the best investment you can make is in yourself!

Start now, live the life of your dreams, and be the change that inspires a collective rise to financial freedom.